Happy To Discuss About Your Requirement? Get a Quote

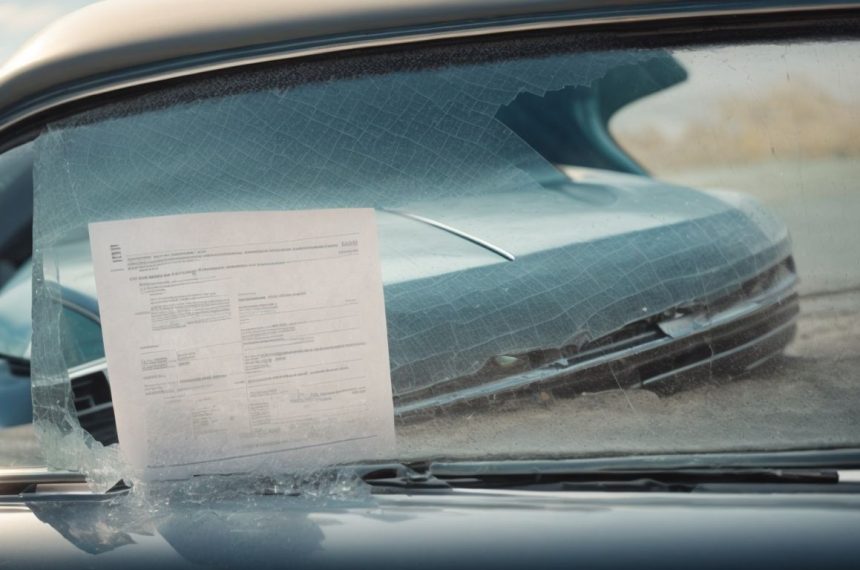

Auto glass claims in Florida can be confusing. Understanding auto glass insurance laws and the benefits of comprehensive insurance is essential.

This article provides an overview of the legal aspects of auto glass claims, the importance of full glass insurance, and recommendations for auto insurance providers in Florida.

Stay informed about mandatory glass coverage, deductibles, and the impact of windshield repair claims on premiums. Explore everything you need to know about auto glass claims in Florida.

Understanding Auto Glass Claims in Florida involves navigating the complexities of insurance policies, glass coverage options, and the process of windshield repairs with various auto insurance providers.

Florida residents who have auto glass claims must determine whether their insurance policy includes comprehensive coverage to protect against damage to their vehicle’s glass.

If there is a windshield repair or replacement, it’s crucial to communicate with the insurance provider to understand the coverage details and potential deductible costs.

Most insurance companies in Florida facilitate the claim process by working directly with approved auto glass repair shops, streamlining the procedure for policyholders.

Follow the insurer’s specific guidelines to ensure a smooth and efficient resolution of the auto glass claim.

An Overview of Auto Glass Insurance Laws in Florida sheds light on the legal framework governing insurance provisions for drivers, vehicles, and policyholders in the state.

Some specific laws and regulations dictate the rights and obligations of those involved in auto glass insurance in Florida. Drivers must understand their coverage and responsibilities under their insurance policy. Vehicle owners must ensure that their policies comply with state requirements to avoid potential penalties or coverage gaps. Policyholders need to familiarize themselves with the claims process and the extent of coverage provided for glass repairs or replacements.

Florida’s insurance laws mandate that all auto insurance policies cover windshield damage without imposing a repair deductible.

Recognizing the Importance of Full Glass Insurance encompasses safeguarding against unforeseen windshield damages and addressing issues related to damaged auto glass within comprehensive insurance policies.

In terms of protecting your vehicle, Full Glass Insurance is crucial in covering the costs associated with repairing or replacing your windshield, which is prone to cracks and chips caused by road debris or extreme weather conditions.

By integrating Full Glass Insurance within your comprehensive insurance policy, you ensure that even minor issues with your auto glass, such as cracks from stones kicked up by other vehicles, are taken care of without incurring significant out-of-pocket expenses.

Having this type of coverage provides peace of mind. Knowing that your windshield, a critical component for safe driving, is fully protected enhances your overall security on the road.

The Availability of Full Glass Insurance in Florida allows policyholders to secure coverage for auto glass-related incidents, including windshield replacement, and streamline insurance claims processing.

In Florida, full glass insurance is a valuable option for drivers looking to protect themselves from unexpected auto glass incidents. The coverage not only includes windshield replacement but also covers repair for other vehicle glass parts, such as side windows and rear windows. This comprehensive coverage ensures that policyholders can address glass damage without incurring significant out-of-pocket expenses.

One key benefit of having full glass insurance in Florida is the efficient claims processing. When a policyholder needs to file a claim for glass damage, the insurance company handles the process swiftly, ensuring a quick resolution. This convenience saves policyholders time and hassle, allowing them to return to the road with a new windshield or repaired glass in no time.

Full glass insurance also positively impacts policyholders’ overall satisfaction with their auto insurance coverage. Knowing that they are fully protected in the event of glass damage gives drivers peace of mind and confidence in their insurance policy. By opting for full glass insurance in Florida, policyholders can enjoy comprehensive coverage and seamless claims processing, enhancing their overall insurance experience.

Exploring the Legal Aspects of Auto Glass Claims delves into the Federal Requirements, Florida-specific regulations, and legal considerations regarding auto glass and windshield replacement, with insights from experienced legal professionals like GED Lawyers.

Understanding the intricate web of federal mandates is crucial when dealing with auto glass claims. These regulations set the standards for safety and quality in auto glass replacements. Each state, including Florida, has its own set of specific rules governing auto glass issues. Navigating this legal landscape requires expertise and knowledge of the nuanced state laws.

Legal implications of auto glass issues can be far-reaching, impacting insurance claims, liability, and consumer rights. This is where legal firms like GED Lawyers play a pivotal role, offering specialized services to ensure clients receive the appropriate legal support and protection in auto glass claim cases.

Understanding Comprehensive Coverage Requirements involves meeting the state-specific criteria for comprehensive insurance, particularly concerning auto glass repair and addressing issues related to damaged auto glass.

The requirements for insurance coverage for auto glass repair can vary depending on the state in which you reside. Some states mandate comprehensive coverage to include auto glass repair, while others may have specific protocols to follow. It is crucial to understand these regulations to ensure that your damaged auto glass is repaired or replaced by the insurance policy. Factors such as the extent of damage, type of vehicle, and the repair process can all impact the coverage provided by your insurance policy.

Navigating Driving Regulations for Cracked Windshields in Florida involves understanding the legal restrictions, safety implications, and responsibilities of operating vehicles with damaged auto glass.

In Florida, safety is a paramount concern regarding cracked windshields. A damaged windshield can impair visibility, increasing the risk of accidents on the road. By law, any crack or chip larger than a quarter’s diameter should not be in the critical line of sight of the driver. This is crucial to ensure clear visibility and safe driving conditions for drivers and other road users.

Navigating Federal and State Auto Glass Requirements in Florida entails compliance with federal mandates, state regulations, and legal standards concerning auto glass and windshield maintenance, with insights from legal experts like Suarez & Montero.

At the federal level, regulations outline safety requirements for auto glass to ensure the protection of occupants and the structural integrity of vehicles. These guidelines cover aspects such as the type of glass used, transparency levels, and installation procedures.

On the state level, specific laws in Florida may include regulations on windshield cracks, tinting limits, and requirements for auto glass repair facilities. Entities like Suarez & Montero provide valuable assistance in interpreting these legal benchmarks and ensuring businesses comply with the relevant statutes, reducing the risk of legal consequences.

The Benefits of Comprehensive Insurance extend beyond traditional coverage. They offer protection against environmental damage, theft, vandalism, and other unforeseen incidents, ensuring comprehensive safeguarding for policyholders.

Comprehensive insurance policies act as a safety net, shielding policyholders from the financial burden of repairing or replacing their vehicles due to various risks. By including coverage for environmental damage, such as floods or storms, these policies provide a sense of security against unpredictable natural disasters.

In the unfortunate event of theft or vandalism, comprehensive insurance covers the losses, reassuring policyholders that their investments are protected. The peace of mind that comes with knowing that one’s vehicle is shielded from a range of potential risks is invaluable, making comprehensive insurance a wise choice for those seeking enhanced coverage benefits.

Comprehensive Insurance offers robust Protection Against Environmental Damage, safeguarding vehicles from natural elements and environmental hazards prevalent in the state, ensuring thorough coverage for policyholders.

One of the key protective mechanisms provided by comprehensive insurance includes coverage against damages caused by weather events such as hail, storms, and floods, which can wreak havoc on vehicles.

Comprehensive insurance extends protection to policyholders against such natural elements, protecting against unforeseen environmental risks that may lead to costly repairs or replacements.

State-specific environmental risks, such as wildfires in California or hurricanes in Florida, highlight the need for comprehensive coverage that addresses region-specific challenges and ensures that policyholders are adequately protected.

Comprehensive Insurance includes Coverage for Theft and Vandalism, offering policyholders financial protection and reassurance against criminal activities through efficient insurance claims processing.

One key benefit of having theft and vandalism protection within a comprehensive insurance policy is the peace of mind it provides policyholders. Policyholders can rest assured that they are financially covered in case of theft or damage due to vandalism.

The claims process for such incidents is usually straightforward, with policyholders able to report the incident to their insurance company and begin filing a claim. Comprehensive coverage, which includes theft and vandalism protection, adds significant value to an insurance policy by offering a holistic approach to safeguarding against potential losses due to criminal acts.

The Inclusion of Collision Insurance within Comprehensive Coverage broadens the protective umbrella for policyholders, addressing collision-related damages and ensuring holistic financial security for vehicles and policyholders.

Collision insurance, a key component of comprehensive coverage, offers crucial protection in situations involving vehicle collisions. By including collision insurance in their comprehensive policy, individuals safeguard themselves against the financial repercussions of damages resulting from accidents.

This type of insurance ensures that repair or replacement costs following a collision are covered, lessening the burden on policyholders and providing peace of mind regarding their vehicle’s wellbeing. It plays a vital role in enhancing the overall protection and financial security of the insured individual and their vehicle.

Regarding Auto Insurance options, recommendations include GEICO for discount offerings, USAA for benefits tailored to military personnel, and State Farm for an excellent customer service experience catering to diverse policyholder needs.

GEICO is known for its wide range of discounts that help policyholders save on premiums. Whether for safe driving, multiple policies, or vehicle safety features, GEICO offers various ways to lower insurance costs.

On the other hand, USAA stands out for its specialized services designed specifically for military members and their families. USAA understands the unique needs of serving personnel, from deployment assistance to flexible payment options.

Additionally, State Farm prides itself on its customer-centric approach, with agents dedicated to providing personalized guidance and support throughout every step of the insurance process.

GEICO stands out with its vast array of Discount Options, providing policyholders with cost-effective solutions and tailored discounts to enhance their auto insurance coverage.

Among its offerings, GEICO is known for its multiple discount options for policyholders, ranging from safe-driving discounts to bundling policies for additional savings. Policyholders can significantly lower their insurance costs by taking advantage of these tailored discounts while enjoying comprehensive coverage. GEICO’s commitment to offering value goes beyond the traditional discounts, with features like emergency road service coverage and rental reimbursement adding further value to their auto insurance packages.

USAA emerges as an ideal choice for Military Personnel seeking specialized benefits, discounts, and tailored services in the auto insurance landscape. It ensures comprehensive coverage and support for service members.

With a deep understanding of the unique needs of military personnel, USAA goes beyond traditional insurers by offering a range of exclusive perks, such as reduced rates, flexible payment options, and personalized customer service catered specifically to service members and their families.

Moreover, USAA provides access to specialized resources like the Claims Center for rapid assistance during deployment and convenient tools like the Mobile App for easy policy management on the go, making it a trusted ally for those in uniform.

State Farm sets the benchmark for an Excellent Customer Experience in the auto insurance sector, prioritizing policyholder satisfaction, personalized service, and seamless insurance processes.

With a solid dedication to meeting individual customer needs, State Farm goes above and beyond to provide tailored solutions that resonate with each policyholder.

From the initial quote to the claims process, every interaction is designed to be transparent and efficient, ensuring a stress-free experience for all users.

State Farm’s commitment to its policyholders is evident in its proactive communication and readiness to assist in any situation. This creates a sense of security and trust that distinguishes it as a leader in the industry.

Addressing FAQs About Auto Glass Claims in Florida involves clarifying queries related to insurance coverage specifics, glass coverage options, deductible implications, premium impacts, and legal requirements within the state.

In terms of insurance coverage, most Florida auto policies provide comprehensive coverage for auto glass repairs or replacements. This coverage can typically include side windows, rear windows, and windshields. Reviewing your policy details to understand the extent of coverage for glass-related claims is crucial.

In terms of deductibles, some policies have a separate deductible for glass claims, while others may incorporate glass repairs into the comprehensive coverage with a deductible applied. Understanding your deductible structure is essential before filing a claim to avoid unexpected expenses.

Understanding Mandatory Glass Coverage in Florida is crucial for policyholders. This article highlights the state-specific requirements, legal obligations, and insurance provisions pertaining to windshield protection and auto glass coverage.

Florida law mandates that all automobile insurance policies include windshield coverage without a deductible, ensuring drivers can get necessary repairs or replacements without significant out-of-pocket expenses. This regulation promotes road safety by encouraging prompt fixes for windshield damage, boosting visibility and structural integrity. Failure to comply with this requirement can result in fines or penalties, and policyholders need to understand the implications of not adhering to the state’s glass coverage regulations.

Understanding Deductibles with Full Glass Coverage entails clarifying the deductible structures, coverage implications, and financial considerations associated with Full Glass insurance for policyholders seeking optimal insurance protection.

Regarding full glass coverage, deductibles are crucial in determining the extent of financial responsibility the policyholder will have in the event of a claim. A deductible is the amount of money the insured person must pay out of pocket before the insurance company starts covering the remaining costs. Generally, the higher the deductible, the lower the premium because the policyholder is taking on more financial risk. Policyholders must find a balance between a higher deductible, which can lead to lower premiums, and ensuring they can afford the deductible if needed.

Assessing the Impact of Windshield Repair Claims on Premiums involves analyzing the financial repercussions, premium adjustments, and insurance effects resulting from damaged auto glass incidents and windshield repair claims.

When a policyholder submits a windshield repair claim, the insurance company typically covers the cost, which can trigger inevitable consequences. Insurers may categorize these claims differently, impacting how they treat a policyholder. Due to increased claim frequency, insurance premiums can rise, affecting the individual claimant and the broader group of policyholders.

Continuous windshield repair claims could label the policyholder as a higher risk, leading to adjustments in premiums or coverage terms. Ultimately, these processes shape insurance outcomes, demonstrating how each claim affects the landscape.

Exploring the Potential Consequences of a Broken Windshield illuminates the safety risks, legal implications, repair requirements, and financial ramifications associated with damaged auto glass incidents, emphasizing the importance of prompt repairs and insurance coverage.

When a vehicle’s windshield is compromised, it can pose severe safety hazards for the driver and passengers. A cracked or shattered windshield diminishes the car’s structural integrity, increasing the risk of injury in the event of an accident. A damaged windshield may obstruct the driver’s visibility, leading to potential collisions or accidents. From a legal perspective, driving with a broken windshield could result in citations or fines as it violates safety regulations.

Client Reviews and Testimonials provide valuable insights into the quality of auto glass repairs, windshield replacements, and legal assistance from personal injury attorneys or car accident lawyers, offering a comprehensive overview of service experiences.

When clients take the time to share their experiences with auto glass repair and windshield replacement services, they not only offer feedback on the technical expertise and efficiency of the procedures but also shed light on the customer service aspect. Beyond the physical repair or replacement, customers often mention the communication skills and responsiveness of the professionals, highlighting how important it is to feel supported throughout the process.

Testimonials frequently emphasize the peace of mind that comes from expert legal guidance after a car accident, praising the compassion and expertise of personal injury attorneys.

© 2024, Alpha Law Group